Your Guide to an Insurance Agency Virtual Assistant

Discover how an insurance agency virtual assistant can reclaim your team's time and drive growth. Compare human vs AI solutions and learn to implement them.

Jan 20, 2026

An insurance agency virtual assistant is a remote professional who steps in to handle the administrative, technical, or even creative work that keeps an agency running smoothly. Think of them as a key player on your team, just located off-site. Their primary role is to free up your licensed agents and customer service representatives (CSRs) so they can focus on high-value work—like advising clients and growing your book of business—instead of getting bogged down in paperwork.

The Hidden Costs of Administrative Overload

In the current insurance market, the pressure is on. Clients demand instant answers and immediate service, turning what used to be simple administrative requests into urgent, workflow-wrecking fires that need to be put out now. This constant state of reaction creates a massive bottleneck, trapping your most valuable, licensed professionals in a cycle of tasks that don't generate a dime of revenue.

It’s like asking a skilled surgeon to handle patient scheduling. Sure, scheduling is critical, but it’s hardly the best use of a surgeon's expertise. In the same way, when your best agents and CSRs are buried in administrative duties—processing endorsements, updating the Agency Management System (AMS), or issuing Certificates of Insurance—they aren't consulting with clients or bringing in new business.

The Growing Burden of Repetitive Tasks

This administrative drag is far more than a simple annoyance; it’s a silent drain on your agency’s productivity and, ultimately, its profitability. Every minute a licensed professional spends on manual data entry is a minute they’re not building relationships, cross-selling policies, or prospecting for new leads. For agency principals and their teams, the daily frustrations are all too familiar:

Constant Interruptions: A never-ending stream of requests for documents like COIs shatters focus and chops the day into unproductive pieces.

Time-Consuming Data Entry: Manually keying in client information across different systems is not only tedious but also ripe for human error.

Mounting Client Expectations: Slow delivery of documents or answers can quickly lead to frustrated clients and, worse, client churn.

These problems are only getting worse as call volumes rise and everyone expects instant connectivity. In fact, industry data shows that 77% of customers expect to reach someone immediately when they contact a business. For an agency, failing to meet that expectation can mean leaving thousands in annual premium revenue on the table from missed opportunities.

The real problem is this: your highly skilled, highly paid team members are spending their days on tasks far below their pay grade. This leads directly to burnout, plummeting job satisfaction, and a stalled growth path for the entire agency.

A Strategic Solution to Reclaim Time

This is where an insurance agency virtual assistant comes in—not just as an extra pair of hands, but as a strategic part of the solution. By taking on the high-volume, repetitive work that eats up so much of the day, they empower your team to shift their energy back to where it counts.

Managing the endless flow of COIs is a perfect example and often the first pain point agencies look to solve. Getting a handle on this process with something as simple as a standardized certificate of insurance template can be a great first step toward creating more efficient workflows.

In the end, tackling administrative overload is about getting back your most valuable resource: time. It’s about letting your licensed agents do what they do best—advise, sell, and strengthen the client relationships that form the foundation of your agency’s success.

Understanding Your Virtual Assistant Options

When agency principals hear “virtual assistant,” they usually picture one thing: a remote person handling basic tasks. But that’s an outdated view. Today, the virtual assistant world has split into two very different paths, and knowing which one to take is the first real step in getting the right kind of help for your agency.

At the end of the day, both options are trying to solve the same problem—getting the endless, time-sucking admin work off your licensed team’s plate. But how they get that work done is what really matters. That choice ripples through everything, from your costs and ability to scale to the accuracy of the work and how it connects with your core systems.

The Two Core Models of Virtual Assistance

The first path is the one most people are familiar with: the human virtual assistant (VA). This is a real person, typically hired through a BPO or staffing firm, who works remotely to handle a defined list of tasks. Think of them as a remote employee. They need to be trained on your systems, managed, and given clear instructions to do their job well.

The second path is much newer: the AI Teammate. This isn't a person at all, but rather a specialized software platform built from the ground up to execute specific insurance workflows automatically. An AI Teammate works on its own within set rules, knocking out tasks with the speed and precision only a machine can offer, without needing someone to watch over its shoulder every step of the way.

Here’s a good way to think about it: A human VA is like hiring a personal chef. You have to give them your recipes (your SOPs), show them around your kitchen (your systems), and keep an eye on their cooking. An AI Teammate is more like a smart oven with pre-programmed recipes—you just pick the dish (the task), and it handles the entire process perfectly, every single time.

Common Workflows They Manage

Whether you go with a human VA or an AI Teammate, the goal is to take on the high-volume, repetitive work that grinds your account managers and CSRs to a halt. While their approaches couldn't be more different, the tasks they target are often the same.

Here are a few of the biggest time-sinks a virtual assistant can handle:

Issuing Certificates of Insurance (COIs): This is a classic. They can generate and send out accurate COIs based on requests, freeing up hours of your team's day.

Processing Policy Endorsements: Managing all the client requests for policy changes, from updating the carrier portal to confirming everything back in your Agency Management System (AMS).

Updating the Agency Management System (AMS): Keeping client data, policy details, and documents perfectly entered and organized in systems like Applied Epic or Vertafore AMS360.

Assembling Insurance Submissions: Pulling together all the documents and data needed to get a risk ready for market submissions.

How Their Operational Methods Differ

So, how does the work actually get done?

A human VA gets the job done by following a checklist you give them. To issue a COI, for example, you have to train them on logging into your AMS, finding the right client, pulling up the policy, filling out the cert with the correct holder information, and finally, sending it off. It’s a manual, step-by-step process that requires their focused attention for every single request.

An AI Teammate, on the other hand, is purpose-built for these workflows. With a platform like Acolite, an AI Teammate for insurance agencies, the entire process is automated. Your team simply forwards the COI request email, and the AI takes over. It reads the email, securely accesses the AMS, generates the certificate with the right language, and delivers it—all in a fraction of the time.

This fundamental difference in how they operate is what really sets the stage for everything that follows. It's the key to understanding their true benefits and limitations.

Human VAs vs AI Teammates: A Practical Comparison

Choosing the right kind of support for your agency isn’t just about offloading tasks; it's a strategic decision that shapes your ability to grow, your operational costs, and even your data security. While both human virtual assistants and the new wave of AI Teammates promise to cut down on administrative drag, they get there in fundamentally different ways.

Figuring out those differences is the key to picking the solution that actually solves your agency's real-world problems.

A human VA brings a level of flexibility and a personal touch, perfect for tasks that need a bit of nuance. On the other hand, an AI Teammate delivers pure speed and flawless consistency for those high-volume, repetitive workflows that bog everyone down. The question isn't which one is "better," but which is the right tool for the job you need done.

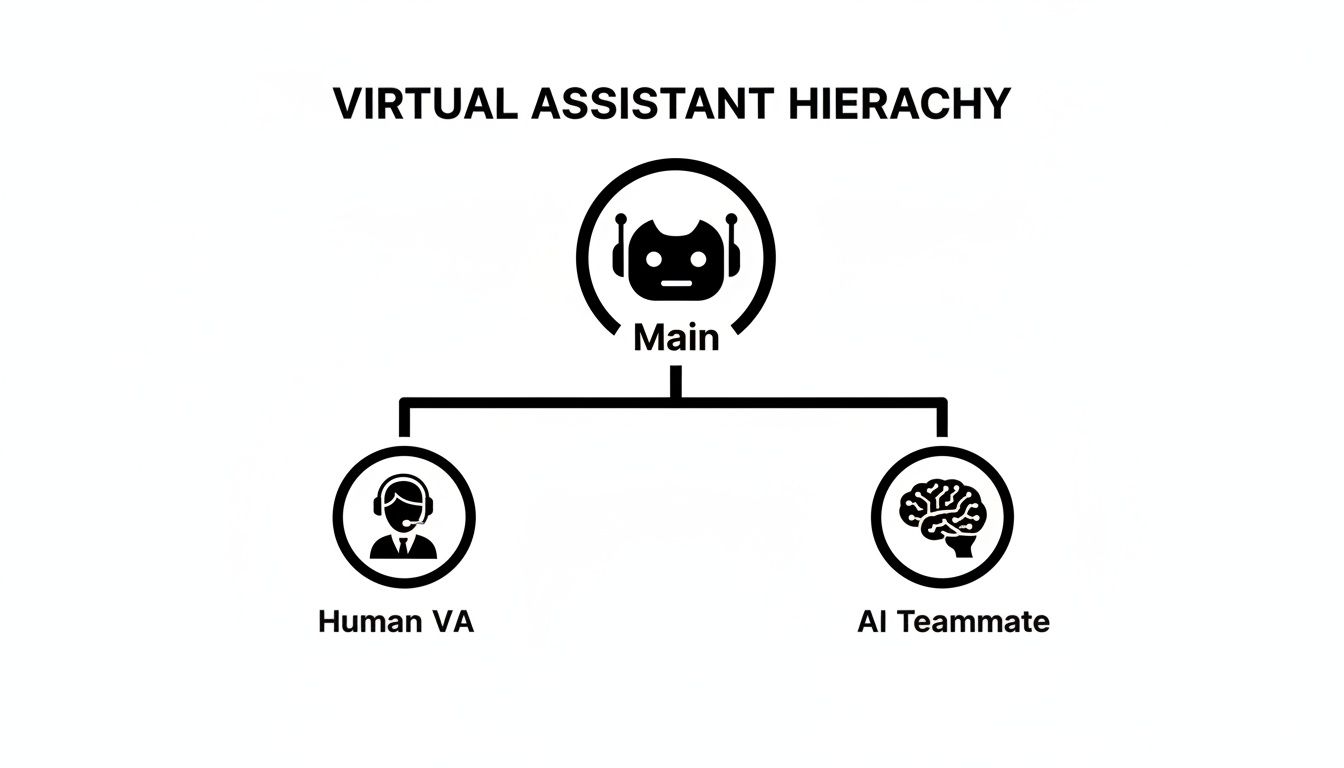

This diagram shows how these two options branch off from the main idea of virtual assistance.

As you can see, while both fall under the "virtual assistant" umbrella, they represent two very distinct ways of operating.

Scalability and Processing Speed

One of the biggest divides is how each handles a growing workload. A human insurance agency virtual assistant is, well, human. They can only focus on one task at a time and have a limited number of hours in the day. If a big client suddenly needs dozens of COIs, your VA can quickly become the new bottleneck.

An AI Teammate, in contrast, is built for exactly that kind of surge. It can process hundreds or even thousands of requests at the same time without breaking a sweat or making a single mistake.

Human VA: Capacity is linear. If you want to double the work, you have to hire a second VA, which doubles your cost and your management time.

AI Teammate: Capacity is elastic. It can handle a massive influx of requests—like when a new construction project kicks off—and then scale right back down, all for the same cost.

This gives AI a level of operational agility that’s tough for a human-powered model to match, especially for agencies with seasonal peaks or those on a fast-growth track.

Cost Structure and Long-Term Value

The way you pay for these two services couldn't be more different. A human VA usually works on an hourly rate or a monthly retainer, much like a part-time employee. It might be cheaper than a full-time hire, but the costs add up based on hours worked, not necessarily on the volume of work completed.

AI Teammates, like Acolite, typically run on a predictable subscription model. You pay a flat fee that isn’t tied to how many tasks it handles.

The real game-changer is the ROI. A human VA’s value is locked to their time. An AI Teammate’s value is tied directly to its output. When an AI can complete a task in seconds that takes a person 15 minutes, it delivers exponentially more value for a fixed price.

This structure allows agencies to push through a much higher volume of administrative work without seeing their labor costs balloon. Over time, that creates a serious financial advantage.

Accuracy, Consistency, and Data Security

When you’re dealing with repetitive tasks, consistency is king. Even the most detail-oriented person can have an off day, leading to typos, missed steps, or inconsistent data entry in your AMS. Those small slip-ups can create major E&O exposure and force your team to waste time double-checking everything.

AI Teammates eliminate human error from the equation. They follow their programming perfectly, every single time. This ensures every COI, endorsement, and AMS update is handled with 100% consistency, which is critical for compliance and maintaining clean, reliable data.

Data security is another area where the two diverge sharply. Granting a remote human VA access to your Agency Management System (AMS) means introducing a significant security variable. You're trusting an individual with sensitive client PII and navigating the complexities of user permissions.

AI platforms, however, are engineered with security at their very core.

Human VA Security: Relies on trust, NDAs, and secure remote access tools. The human element will always be the weakest link.

AI Teammate Security: Uses secure, API-based integrations. The AI only accesses the specific data fields it needs to do its job, without ever getting broad, user-level access to your entire system. Many top platforms are also SOC 2 compliant, offering a verifiable seal of approval for their security practices.

To help you weigh these factors, here's a side-by-side look at how a human VA and an AI Teammate stack up on the issues that matter most to an agency.

Human Virtual Assistant vs AI Teammate for Insurance Agencies

Feature | Human Virtual Assistant | AI Teammate (e.g., Acolite) |

|---|---|---|

Task Scope | Broad; can handle varied, non-standard tasks and client interaction. | Narrow; excels at high-volume, rule-based tasks like COIs and submissions. |

Scalability | Linear; more work requires more people and more cost. | Elastic; handles massive volume surges instantly with no change in cost. |

Speed | Limited by human work pace (e.g., 10-15 mins/COI). | Near-instantaneous (e.g., under 60 seconds/COI). |

Accuracy | Prone to human error, typos, and inconsistency. | 100% consistent and error-free execution every time. |

Availability | Works standard business hours; subject to time off and sick days. | 24/7/365; processes requests instantly, day or night. |

Cost Model | Hourly rate or monthly retainer; scales with time worked. | Fixed monthly subscription; unlimited task processing. |

Security | Relies on user-based AMS access, NDAs, and individual trust. | Secure API integration; no direct user login, often SOC 2 compliant. |

Training | Requires significant upfront training and ongoing management. | Minimal setup; pre-trained on insurance workflows and systems. |

Ultimately, choosing between a human VA and an AI Teammate comes down to your agency's specific needs. If you need someone to handle a wide variety of complex or client-facing tasks, a human VA is a great fit. But if your goal is to achieve massive speed, scale, and precision for your core administrative workflows, an AI Teammate is the clear winner.

Getting Your New Assistant Set Up for Success

Bringing any new team member on board—whether it’s a person or a piece of software—requires a game plan. You can't just flip a switch and expect magic. A successful rollout is all about thoughtful integration that works with your existing workflows, not against them. The last thing you want is another tool that creates data silos or, even worse, new security holes.

The conversation has to start with your Agency Management System (AMS). It's the central nervous system of your agency, and any insurance agency virtual assistant you hire must connect with it flawlessly. If a solution can't play nice with platforms like Applied Epic, AMS360, or EZLynx, it's simply a non-starter.

Building a Solid Bridge to Your AMS

A good AMS integration is more than just a one-way data pull. It needs to be a two-way street where information flows automatically and accurately. A poorly integrated tool just creates manual workarounds for your team, which completely defeats the purpose of getting help in the first place.

When you're vetting a potential assistant, you need to dig in with some specific questions:

How does it connect? Is it a secure, modern API connection, or does it rely on older, less secure methods like screen scraping?

Can it just read data, or can it also write information back to the AMS—like attaching documents or updating client records?

Was the integration built specifically for insurance systems, or is it a generic connector that's been shoehorned to fit?

Think about it this way: an AI Teammate is often designed with deep, API-level connections. This allows it to not only issue a COI but to then automatically log that activity and attach the final document right back into the client’s file in your AMS. That creates a complete, auditable trail without anyone on your team having to lift a finger.

Putting Data Security Front and Center

In our business, we’re not just handling data; we’re custodians of highly sensitive personally identifiable information (PII). Security can't be an afterthought—it has to be a non-negotiable requirement for any new tool you bring into the agency. The security considerations for a human VA versus an AI Teammate are worlds apart.

Giving a remote human VA access to your systems involves creating user accounts, managing permissions, and trusting that person to follow strict security protocols. It’s doable, but it also introduces a human element, which is notoriously the weakest link in any security chain.

An AI Teammate built on a secure cloud platform takes a different approach. You should look for solutions that are SOC 2 compliant. This certification is a big deal—it’s an independent validation that the provider meets rigorous security and privacy standards. It’s a critical benchmark for any partner handling your clients' data.

An AI platform using secure APIs actually minimizes your exposure. It interacts with your AMS in a tightly controlled, programmatic way, only accessing the specific data fields it needs to complete a task. This is a much more contained and secure model than giving a human user broad access to your entire system. For a closer look at how your data is protected, you can review a provider’s data policies and learn more about their comprehensive privacy policy.

Laying Down the Rules of Engagement

Finally, even the smartest assistant needs clear instructions. For a human VA, this means creating detailed Standard Operating Procedures (SOPs) that map out every single step of a task. These documents are absolutely essential for training and ensuring things are done consistently.

With an AI Teammate, the "SOPs" are essentially coded into its programming. Your job shifts from training a person to configuring the software's rules. For example, you’d set up rules that dictate when a certificate can be issued, what specific language needs to be included for certain holders, or who gets an alert if an exception comes up.

This whole trend toward remote professional support is exploding across every industry. By 2026, specialized insurance virtual assistants are expected to become a core part of U.S. agencies, handling routine tasks and integrating right into our industry-specific tools. This is just one piece of a much larger workforce shift—an estimated 32.6 million Americans will be working remotely by 2026, showing just how widely accepted this model has become. You can dig into more insights on the rise of virtual staffing in insurance on peopleblue.us.

Measuring the True ROI of Your Virtual Assistant

It's one thing to see operational improvements, but the real test for any new hire—human or digital—is the impact on your bottom line. Calculating the return on investment (ROI) for an insurance agency virtual assistant isn't about fuzzy math or guesswork. It’s about putting a hard number on reclaimed time and increased capacity, and the business case it reveals is often more powerful than agency principals expect.

The core idea is simple: connect the time you save directly to revenue. When your licensed, high-value team members are pulled off administrative work, they can finally shift their focus back to what truly grows the agency—advising clients, rounding out accounts, and building new business.

Quantifying the Value of Reclaimed Time

Let's start with a tangible, high-volume task that eats up a ton of your staff's day. Issuing Certificates of Insurance is a perfect example. A skilled account manager might spend 15 minutes on a single COI request, from finding the right form to generating the document and logging it in your AMS. An AI Teammate, on the other hand, can knock out that same task in less than a minute.

This time difference is where your ROI calculation begins. The formula is refreshingly straightforward:

(Time Saved per Task) x (Number of Tasks per Week) = Total Hours Reclaimed Weekly

Picture an agency that handles 50 COIs a week. By shrinking the time per certificate from 15 minutes down to one, you’re saving 14 minutes on every single one.

14 minutes/COI x 50 COIs/week = 700 minutes saved

700 minutes / 60 = 11.6 hours reclaimed every single week

That's almost 12 hours of a skilled employee's time recovered weekly from just one workflow. Annually, that’s over 600 hours—time that can now be invested in client-facing work that actually makes the agency money.

From Time Savings to Revenue Growth

Okay, so you’ve got the hours back. Now, let’s translate that into real dollars. The next step is to assign a monetary value to that time by figuring out the hourly revenue potential of your producers and account managers.

If you value a producer’s time at $200 per hour in potential revenue, those 600 reclaimed hours suddenly represent a massive opportunity for growth.

The True ROI Insight: The goal isn't just about cutting administrative costs. It's about reallocating your most valuable asset—your team's time—from low-impact tasks to high-growth activities.

This isn’t limited to COIs, either. Take scheduling, for instance. A smart AI scheduling assistant can easily save an agent 10 hours per week. For an agency with five producers, that’s 50 additional production hours weekly. At that same $200/hour rate, you're looking at $10,000 in potential weekly value, or $520,000 annually. You can learn more about these productivity multipliers and how they make virtual assistants a strategic necessity over at sonant.ai.

A Practical Agency Case Study

Think about a mid-sized commercial lines agency that brought on an AI Teammate. Their account managers were buried, losing hours every day to COIs, endorsement processing, and endless data entry. After implementing the new system, here’s what happened:

COI Issuance: What once took 15 minutes now took less than 60 seconds.

Team Capacity: Account managers got back an average of 8-10 hours per week.

Growth Focus: They redirected that time into proactive client outreach and account reviews, leading to a 15% increase in cross-sold policies in the first year alone.

Client Retention: With faster service and more attentive account managers, their client retention rate ticked up by 5%.

This real-world example shows that the ROI isn't just a number on a spreadsheet. It’s a tangible outcome that strengthens client relationships, boosts team morale by easing burnout, and paves a clear path to sustainable agency growth.

Your Action Plan for Adopting a Virtual Assistant

Alright, so you're thinking about bringing a virtual assistant on board. Smart move. But going from a good idea to a successful launch requires a solid game plan. This isn't just about hiring help; it's a strategic shift that can genuinely change how your agency operates. Let's walk through the steps to get it right, whether you’re looking at a human VA or an AI teammate.

The first step has nothing to do with technology or hiring. It’s about looking inward. You can't fix a problem until you know exactly what it is, so start by auditing your agency's daily grind to find the real administrative headaches.

Pinpoint Your Biggest Time Sinks

Don't guess where the time goes. For one week, have your team track how long they actually spend on routine administrative tasks. How many minutes does a Certificate of Insurance really take from start to finish? How much of the day is eaten up by manually updating your AMS? The data you gather will shine a spotlight on the low-value, high-volume tasks that are perfect for offloading.

Once you have that clarity, you can set real goals. "Improve efficiency" is too fuzzy. It won't get you anywhere.

A powerful goal is specific and measurable. For example, aim to "reduce COI turnaround time by 90%," or "reclaim 10 hours per week for each account manager." These are concrete targets you can actually measure your success against.

Evaluate Partners and Design a Pilot Program

With clear goals in hand, it's time to start talking to potential partners. When you do, focus your questions on the two things that matter most: security and integration. Ask them point-blank about their SOC 2 compliance and get into the nitty-gritty of how their system connects with your AMS. A secure, API-based integration is what you should be looking for.

Don't jump into a full-blown rollout. Start with a pilot program to test the waters in a controlled way.

Select a Single Workflow: Pick one high-impact task you identified in your audit, like processing COI requests.

Involve a Small Team: Choose a few of your more tech-forward team members to run the pilot. They'll give you the honest feedback you need.

Define Success Metrics: Use the specific goals you set earlier to measure how the pilot is performing. Did you actually hit your target time savings?

Gather Feedback: Talk to the pilot team. What worked? What didn't? Find the friction points now so you can smooth them out before everyone is using the system.

Secure Team Buy-In with a Communication Plan

Finally, and this is crucial, remember that your team is at the center of this change. Most resistance doesn't come from a bad attitude; it comes from people being unsure about how this will affect their jobs. Get ahead of it with a clear communication plan.

Frame the new virtual assistant as a tool, not a replacement. This is about getting rid of the tedious, repetitive parts of their day so they can focus on what they do best: building client relationships and being expert advisors. When you get your team on board as advocates, you're not just adopting a new tool—you're gaining a valuable partner in your agency's growth.

Frequently Asked Questions About Insurance VAs

When agency owners start looking into virtual assistants, a handful of practical questions always come up. These are the real-world concerns that can make or break the whole thing—from handling tricky client requests to keeping sensitive data locked down.

Getting clear on these points helps you understand what different types of assistants can actually do, so you can make a smart choice for your agency.

What About Complex Client Requests?

One of the first questions I hear is, "Can a VA handle a Certificate of Insurance (COI) that needs really specific holder language?" The honest answer is: it completely depends on the type of assistant. A well-trained human VA can definitely learn your agency's custom rules and client quirks over time.

An AI Teammate, on the other hand, is built for exactly this kind of complexity right out of the box. It’s designed to read an email, understand the specific requirements, generate a perfect COI with the right wording, and log it all back into your AMS. It gets it right every time, even for your most demanding accounts.

The real difference is that a purpose-built AI Teammate isn't just following a checklist. It's engineered to interpret and execute complex insurance tasks with precision, truly extending what your team can accomplish without months of training.

How Do You Handle Data Security with Remote Access?

Data security is, of course, non-negotiable in our industry. With a human VA, you manage this risk through rigorous vetting, iron-clad non-disclosure agreements (NDAs), and secure remote access tools that give them just enough permission to do their job—and nothing more.

An AI Teammate provides a fundamentally more secure model. The best platforms are SOC 2 compliant and integrate directly with your AMS using secure APIs. This is a crucial difference. The AI only accesses the specific bits of data it needs for a given task, rather than getting broad, system-level access. This drastically shrinks your agency's risk profile from day one.

How Do VAs Fit in With My Current Team?

This is the big one: "Will an AI Teammate replace my CSRs?" The answer is an emphatic no. The entire point is to make your skilled team better, not to replace them.

Think about all the high-volume, repetitive work that burns out your best people—the constant data entry, the endless document requests. An AI Teammate takes that off their plate. This frees up your CSRs and Account Managers to focus on what they do best: building relationships, advising clients, and spotting opportunities to grow the business. It makes their jobs more strategic, more valuable, and a lot more satisfying.

Ready to see how an AI Teammate can handle your most repetitive tasks with perfect accuracy? Discover Acolite and reclaim valuable time for your agency. Learn more at https://www.acolite.ai.